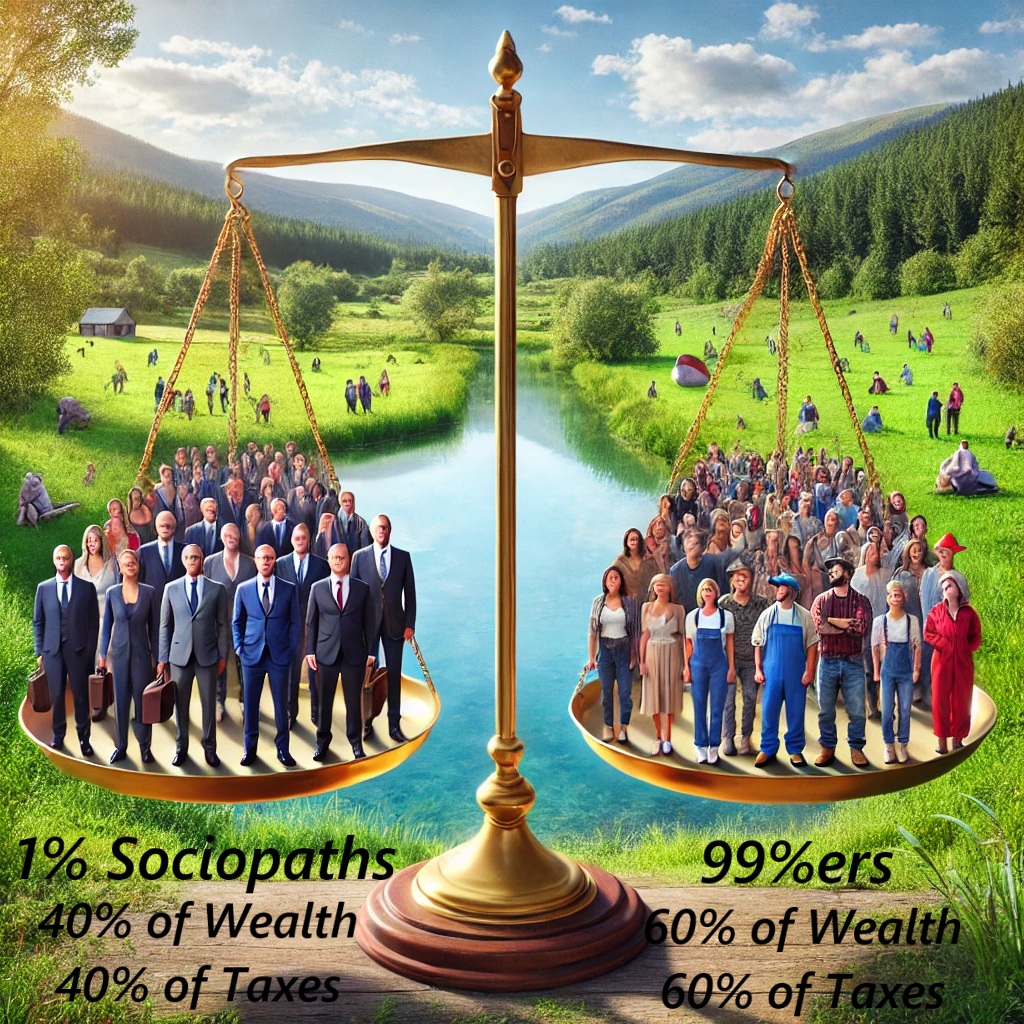

You pay more in taxes than billionaires. This Act fixes that

Fair Tax Elimination of Income Tax Act (FTEITA)

🎥 Watch: What is the Fair Tax Elimination of Income Tax Act (FTEITA)?

Here’s what FTEITA does:

- 🚫 Eliminates federal income tax, corporate tax, inheritance tax, tariffs, and excise taxes.

- 💸 Replaces them with:

- ✔️ A 1.55% national sales tax

- ✔️ A 4.5% property tax on wealth over $500,000

- 🛑 Requires a 2/3 vote in Congress to repeal or amend the law—no easy reversals.

- 📉 Cuts compliance costs, ends loopholes, and reduces the federal deficit and debt.

- 💰 Saves Americans thousands per year and increases GDP by 7.12% annually.

Frequently Asked Questions

Will this hurt low-income individuals?

No. The proposed sales tax is minimal, and essential goods may be exempted or rebated to protect low-income households.

How will businesses be affected?

Businesses are expected to benefit from simplified tax codes and increased consumer spending power.

Is there a risk of both income and sales taxes being imposed?

The act includes provisions to prevent the reintroduction of income taxes, ensuring a singular, fair tax system.